Can Your Portfolio Handle The Cost of Having no Long Term Care Insurance?

I have met very few people who believe that their retirement portfolio is “enough.” From the person with 100K to the person with 2 million, nearly every one of them has some concerns if there is enough there to meet their lifestyle goals for all of retirement.

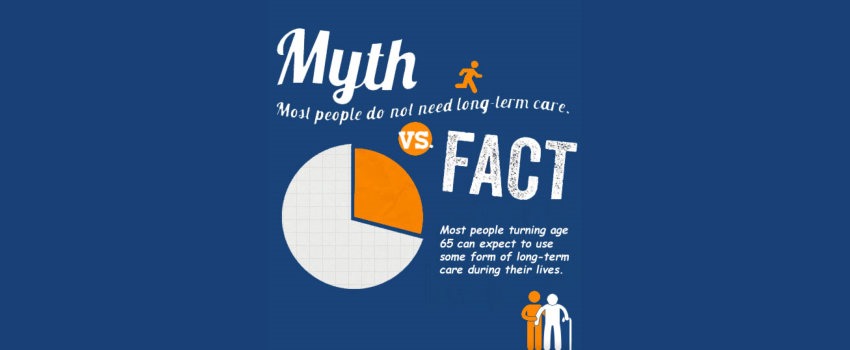

However, I have met several people who have this idea they can “pay for their long term care out of their pocket” if they will need it down the years. This may be true. Current estimates are that long term care costs will double about every 15 years. So if I am talking to someone who is 55 years old who has 1 million tucked away, maybe just maybe they can take the hit of an extended run of long term care. But they might not be able to take the hit for two people.

Let’ me show you the math:

| Cost of Care per month | Cost for 3 year run of care | |

|---|---|---|

| Age 55 | Nursing home = $7,000 month in the mid-west | 7K X 36 months = $216,000 |

| Age 70 | $12,000/month | $432,000 |

| Age 85 | $24,000/month | Over $800K for 3 years of care |

An Example:

If Mr. and Mrs. Purple have 1.2 million in net worth at age 65 when they retire, they can expect that their investment portfolio will crank off about 4% for income for them each year. If their lifestyle is in the neighborhood of 50K per year, then they can live on the return on the investment alone and not have to tap the asset. But if ONE of them starts to need care, they now have to tap the asset to pay for it. And what happens to the income from that capital? It drops. As capital drops, so will the return and the return IS the income in retirement!

Learn more at LongTermCare.gov

So even if a couple might be able to fully pay for the cost of long term care for the first person, the real questions is can the surviving spouse withstand the hit in income if you DO tap the asset…..? Beyond that, if the surviving spouse needs care 10 to 15 years later, will there be enough for this person or will s/he end up in welfare-level care?

You cannot just look at a lump of invested dollars and determine if you have enough to pay for an extended run of care. You have to do the math and project forward in time to know if your pockets are deep enough to cover te cost of care AND meet all the other financial obligations you have on the table.

Questions?

Contact - Mrs. LTC

Long Term Care Claims & Insurance

Question about a Claim?

Shopping for coverage?

Leave A Comment

You must be logged in to post a comment.